Social Security Updates: What You Need to Know for 2024

Table of Contents

- 8,600 - New Social Security Maximum Taxable Earnings in 2024 - YouTube

- Social security tax rates in Europe 2024

- 3 - Social Security Is INCREASING in 2024… Here’s the Exact AMOUNT ...

- Social Security Withholding For 2024 Ford - Amelie Steffi

- Social Security Withholdings 2024 - Gusta Lorrie

- Max Social Security Tax 2024 Dollar Amount For 2024 - Sena Xylina

- Will the IRS Tax Bracket changes affect my Social Security check?

- Social Security Tax Rising To 17.5% In 2024: Here’s What You Need to Know

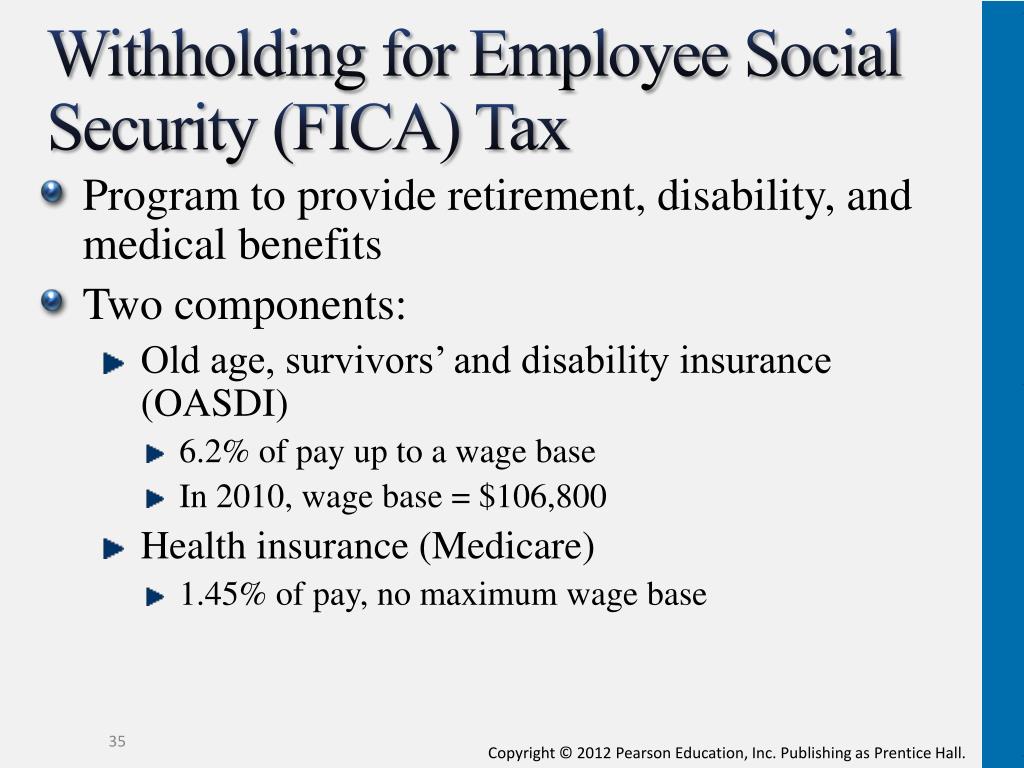

- Fica And Medicare Withholding Rates For 2024 Withholding - Nani Tamara

- Social Security Cost-of-Living Adjustment (COLA) for 2024 | Balin Law ...

Social Security Wage Base for 2024

Cost of Living Adjustment (COLA) for 2024

How the COLA Affects Benefits

The COLA increase will be applied to all Social Security benefits, including retirement, disability, and survivor benefits. The exact amount of the increase will depend on the individual's benefit amount, but on average, beneficiaries can expect to see an increase of around $50-60 per month. This increase may not seem like a lot, but it can make a significant difference for those relying on Social Security benefits as their primary source of income.

Other Important Updates for 2024

In addition to the wage base and COLA updates, there are a few other changes to be aware of for 2024: The earnings limit for workers who are receiving Social Security benefits and are under full retirement age will increase to $21,240 per year. If you earn above this amount, you may see a reduction in your benefits. The SSA will also increase the maximum monthly benefit amount for workers who retire at full retirement age. This amount will depend on the individual's earnings history and retirement age. The Social Security updates for 2024 are designed to help keep pace with inflation and ensure that benefits continue to provide a vital source of income for millions of Americans. Whether you're a current beneficiary or planning for retirement, it's essential to stay informed about these updates and how they may impact your benefits. By understanding the changes to the Social Security wage base and COLA, you can better plan for your financial future and make the most of your Social Security benefits.Stay ahead of the curve and plan for your retirement with confidence. For more information on Social Security updates and how they may affect you, visit the Social Security Administration website or consult with a financial advisor.